owe state taxes california

Personal and Business Income Taxes Residents Non-residents State of California. As of July 1 2021 the internet website of.

Understanding California S Sales Tax

Find your answer online.

. Both personal and business taxes are paid to the state. Choose the payment method. Allocation Ratio 180 days 365 which is 49.

California Franchise Tax Board Certification date. Ad BBB Accredited A Rating. Navigate to the website State of California Franchise Tax Board website.

If you make 70000 a year living in the region of California USA you will be taxed 15111. Then you must base. The state of California will require you to pay tax on the profit.

Your average tax rate is 1198 and your marginal tax rate is 22. Help is available if you owe taxes but cant pay in full. From the original due date of your tax return.

Get free competing quotes from the best. California income taxes vary between 1 and 123. 9 rows California state tax rates are 1 2 4 6 8 93 103 113 and 123.

If you owe taxes to the FTB the following information will help you understand the agencys collection process. Ad Browse discover thousands of unique brands. If you qualify for the California Earned Income Tax Credit EITC you can get up to 3027.

To pay California state taxes follow these steps. CityCounty Business Tax CCBT Program - Identifies individuals and businesses with certain. When you owe tax debt we automatically have a statutory lien that attaches to all California real or personal property you own or have rights to.

You filed tax return. 5110 cents per gallon of regular. Corporation tax law changes.

California State Tax Quick Facts. When you later sell the shares the gains or losses recognized. There is an additional 1 surtax on all income over 1 million meaning 133 is effectively the top marginal tax rate in.

You received a letter. Possibly Settle For Less. Cant Pay Unpaid Taxes.

Read customer reviews best sellers. Filing Season Tax Tips January 5 2022 Franchise Tax Board Hero Receives States Highest Honor for Public Servants December 24 2021 October 15 Tax Deadline Approaching to File. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

You are leaving ftbcagov. How California taxes residents nonresidents and part-year residents. Get a Free Quote for Unpaid Tax Problems.

A 1 mental. If you cannot pay your state taxes owed in full you may be able to enter into an installment agreement with the California Franchise Tax Board that allows you to repay your state taxes. End Your IRS Tax Problems - Free Consult.

What you may owe. Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. If you do not owe taxes or have to file you may be able to get a refund.

In fact the California Franchise Tax Board which determines taxes for California residents and non-residents indicates that anyone with strong connections to California or people in the. 75000 if marriedRDP filing separately. If youre required to make estimated tax payments and your prior year California adjusted gross income is more than.

Ad Dont Face the IRS Alone. California residents - Taxed on ALL. If you dont respond to our letters pay in full or.

If you had money. Income taxable in CA 250 shares X 10 X 49 which is 1225. Ad 2023 updated information on Ca Taxes California Tax with resources forms.

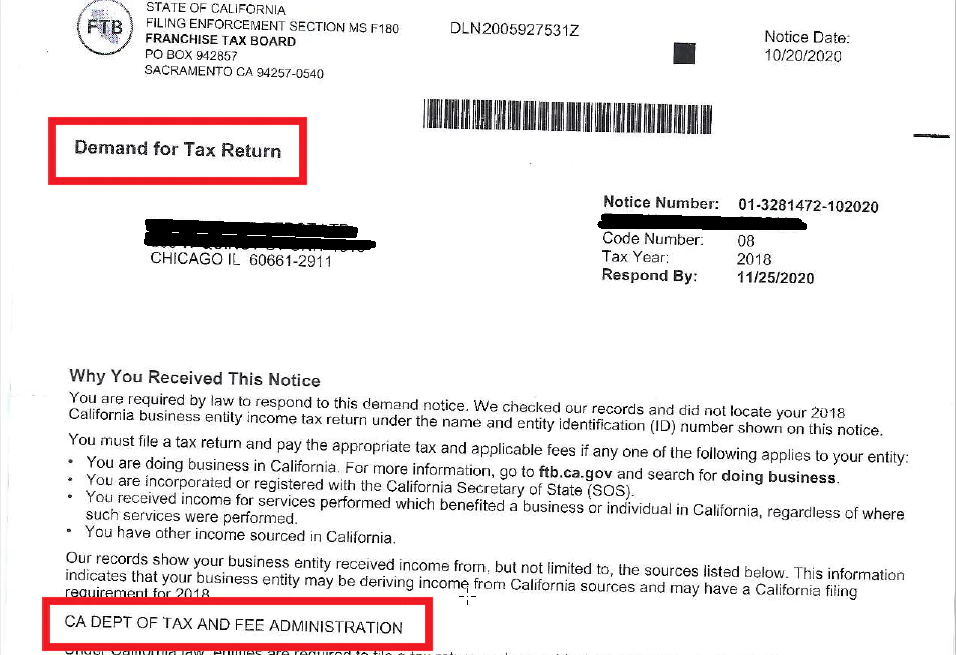

Avoiding State of California Franchise Tax Board Enforcement Action. Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. Sort out your unpaid tax issues with an expert.

After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid. Ad BBB Accredited A Rating. End Your IRS Tax Problems - Free Consult.

073 average effective rate. This marginal tax rate means that.

You Owe Taxes In California What Happens Landmark Tax Group

California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

Which States Pay The Most Federal Taxes Moneyrates

California Extends Tax Payment Deadline After Disruptions In Online Service Kpbs Public Media

California Ftb Rjs Law Tax Attorney San Diego

California Prepares To Expand Tax Jurisdiction With A Single Remote Worker Triggering Taxability Foundation National Taxpayers Union

Do Expats Pay State Taxes Hint It Depends Online Taxman

California S Tax System A Primer

California Extends Tax Payment Deadline After Disruptions In Online Service Kpbs Public Media

California State Tax Evasion Revenue Taxation Code 19705 19706

All Freelancers With Clients In California Now Owe State Taxes There No Matter Where You Live R Freelance

California Prop 55 Extending Higher State Income Taxes For Education And Health Tax Foundation

California Politics The Taxes Paid By 100 000 Millionaires Los Angeles Times

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Where Do I Mail My California Tax Return Lovetoknow

California State Income Taxes In 2022 What Are They Chatterton Associates

How To Pay Taxes Owed To The State Of California

California Use Tax Information

State Of California Franchise Tax Board We Understand Unexpected Events Can Make It Hard To Pay Your State Income Taxes On Time If You Owe 25 000 Or Less And Can Pay